Never Miss A Refi Opportunity.

Set Your Target Rate. Automate Your Outreach.

Automatically notify clients when their desired rate is available and keep your team in the loop—no manual tracking required.

Empower clients to act fast on rate changes—without lifting a finger.

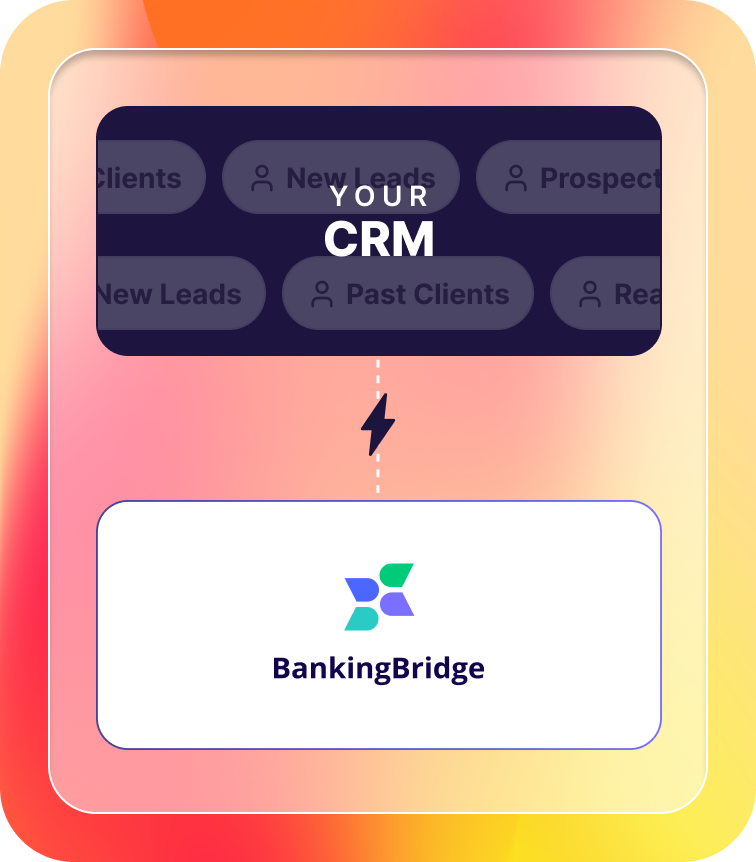

Leads in your CRM are sent to BankingBridge

Leads don’t need to be entered twice — they’re automatically pushed from your CRM into BankingBridge.

We continuously monitor your database for the borrower's desired rate.

No manual checking needed — we automatically track rate movements through your pricing engine.

An email is sent to your team and the lead when the desired rate is reached.

This keeps your team and the borrower informed when the target rate is available, enabling faster follow-up.

Pricing

- Includes 500 leads monitored

- Pricing run weekly on all leads

- Supports all standard first mortgage products

- Manual upload supported

- Each additional lead is .20 cents per month

Frequently Asked Questions

Rate Drop is an automated monitoring and engagement tool that tracks a lead’s saved rate scenario and alerts both the borrower and loan officer when market rates reach or beat their desired target — turning your existing database into refinance opportunities automatically.

When a lead saves a rate scenario or sets a target rate, Rate Drop continuously monitors live pricing data. Once the market rate meets the target, the system instantly sends:

An email notification to the lead announcing their new savings opportunity.

A notification to the assigned loan officer identifying the lead and linking to their rate dashboard.

When a target is hit, Rate Drop triggers both borrower and LO notifications in real time. This ensures the loan officer can act quickly while the borrower’s interest is highest.

Yes. Leads can be automatically enrolled from your CRM data into BankingBridge, where you can set a target rate for each contact to trigger rate drop notifications and weekly rate updates — keeping your database active and engaged.

Yes. Data from your CRM can be seamlessly sent to BankingBridge to create Rate Drop opportunities automatically. All activity — including rate triggers, lead updates, and alerts — flows between systems so your loan officers can act the moment a lead becomes active.

When a lead’s target rate is reached they’re automatically enrolled in weekly rate update emails to stay informed on their personalized rate scenario and future market changes.

Rate Drop keeps your database active and engaged. By automatically alerting leads at the right time, lenders see higher reactivation rates, lower cost per funded loan, and a consistent flow of refinance opportunities — without extra manual work.